What’s New: Credit Reduction State

A state that hasn’t repaid money it borrowed from the federal government to pay unemployment benefits is a “credit reduction state.” The U.S. Department of Labor determines these states. If an employer pays wages that are subject to the unemployment tax laws of a credit reduction state, that employer must pay additional federal unemployment tax when filing its Form 940. For 2022, the credit reduction rate applies to the following states and U.S. territory: California, Connecticut, Illinois, New York and the U.S. Virgin Islands.

Suppose an employee paid any wages that are subject to the unemployment compensation laws of a credit reduction state. In that case, their credit against federal unemployment tax will be reduced based on the credit reduction rate for that credit reduction state. Use Schedule A (Form 940) to figure out the credit reduction. See the Schedule A (Form 940) instructions for more information or visit IRS.gov.

Who Must File Form 940?

Other than specific exceptions, if you answer “Yes” to either one of these questions, you must file Form 940.

- Did you pay wages of $1,500 or more to employees in any calendar quarter during 2021 or 2022?

- Did you have one or more employees for at least some part of a day in any 20 or more different weeks in 2021 or 20 or more different weeks in 2022?

Count all full-time, part-time, and temporary employees. However, if your business is a partnership, don’t count its partners.

Reminders

What To Do If You Change Your Business Name, Business Address, Or Responsible Party?

Notify the IRS immediately if you change your business name, business address, or responsible party.

- Write to the IRS office where you file your returns (using the Without a payment address under Where Do You File) to notify the IRS of any business name change. See Pub. 1635 to see if you need to apply for a new employer identification number (EIN).

- Complete and mail Form 8822-B to notify the IRS of a business address or responsible party change. Don’t mail Form 8822-B with your Form 940. For a definition of “responsible party,” see the Instructions for Form SS-4.

Federal Tax Deposits Must Be Made By Electronic Funds Transfer (EFT). You Must Use EFT To Make All Federal Tax Deposits.

Generally, an EFT is made using the Electronic Federal Tax Payment System (EFTPS). If you don’t want to use EFTPS, you can arrange for your tax professional, financial institution, payroll service, or other trusted third party to make electronic deposits on your behalf. Also, you may arrange for your financial institution to initiate a same-day wire payment on your behalf. EFTPS is a free service provided by the Department of the Treasury. Services provided by your tax professional, financial institution, payroll service, or other third parties may have a fee.

Electronic Funds Withdrawal (EFW)

If you file Form 940 electronically, you can eFile and use EFW to pay the balance due in a single step using tax preparation software or through a tax professional. However, don’t use EFW to make federal tax deposits. For more information on paying your taxes using EFW, go to IRS.gov/EFW.

Credit Or Debit Card Payments

You may pay your FUTA tax shown on line 14 using a credit or debit card. Your payment will be processed by a payment processor who will charge a processing fee. Don’t use a credit or debit card to pay taxes that are required to be deposited (see When Must You Deposit Your FUTA Tax, later). For more information on paying your taxes with a credit or debit card, go to IRS.gov/PayByCard.

Online Payment Agreement

You may be eligible to apply for an installment agreement online if you can’t pay the full amount of tax you owe when you file your return.

State Unemployment Information

When you registered as an employer with your state, the state assigned you a state reporting number. If you don’t have a state unemployment account and state experience tax rate, or if you have questions about your state account, you must contact your state unemployment agency. For a list of state unemployment agencies, visit the U.S. Department of Labor’s website at oui.doleta.gov/unemploy/agencies.asp.

When Must You Deposit Your FUTA Tax?

Although Form 940 covers a calendar year, you may have to deposit your FUTA tax before you file your return. If your FUTA tax is more than $500 for the calendar year, you must deposit at least one quarterly payment.

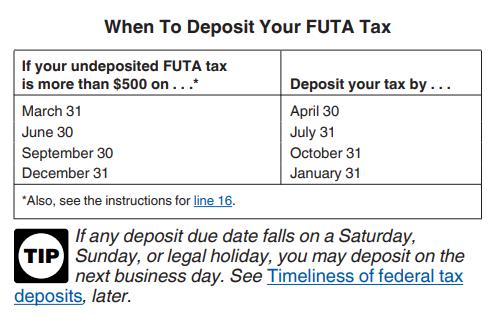

You must determine when to deposit your tax based on the amount of your quarterly tax liability. If your FUTA tax is $500 or less in a quarter, carry it over to the next quarter. Continue carrying your tax liability over until your cumulative tax is more than $500. At that point, you must deposit your tax for the quarter. Deposit your FUTA tax by the last day of the month after the end of the quarter. If your tax for the next quarter is $500 or less, you’re only required to deposit your tax again once the cumulative amount is more than $500.

Fourth Quarter Liabilities

If your FUTA tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is more than $500, deposit the entire amount by January 31, 2023. If it is $500 or less, you can either deposit the amount or pay it with your Form 940 by January 31, 2023.

In years when there are credit reduction states, you must include liabilities owed for credit reduction with your fourth quarter deposit.

Timeliness Of Federal Tax Deposits

If a deposit is required to be made on a day that isn’t a business day, the deposit is considered timely if it is made by the close of the next business day. A business day is any day other than a Saturday, Sunday, or legal holiday. The term “legal holiday” for deposit purposes includes only those legal holidays in the District of Columbia. Legal holidays in the District of Columbia are provided in section 11 of Pub. 15.

For a complete explanation of Form 940 instructions, click here.