Several states have released their state unemployment insurance (SUI) taxable wage bases for 2023. Employers should be aware that due to UI trust fund balances that are lower than anticipated and economic concerns regarding employer taxes, some states may make changes to their taxable wage bases later this year or early next year.

The Federal Unemployment Tax Act (FUTA) requires that each state’s taxable wage base must at least equal the FUTA taxable wage base of $7,000 per employee, and most states have wage bases that exceed the required amount. The states use various formulas for determining the taxable wage base, with a few tying theirs by law to the FUTA wage base and others using a percentage of the state’s average annual wage.

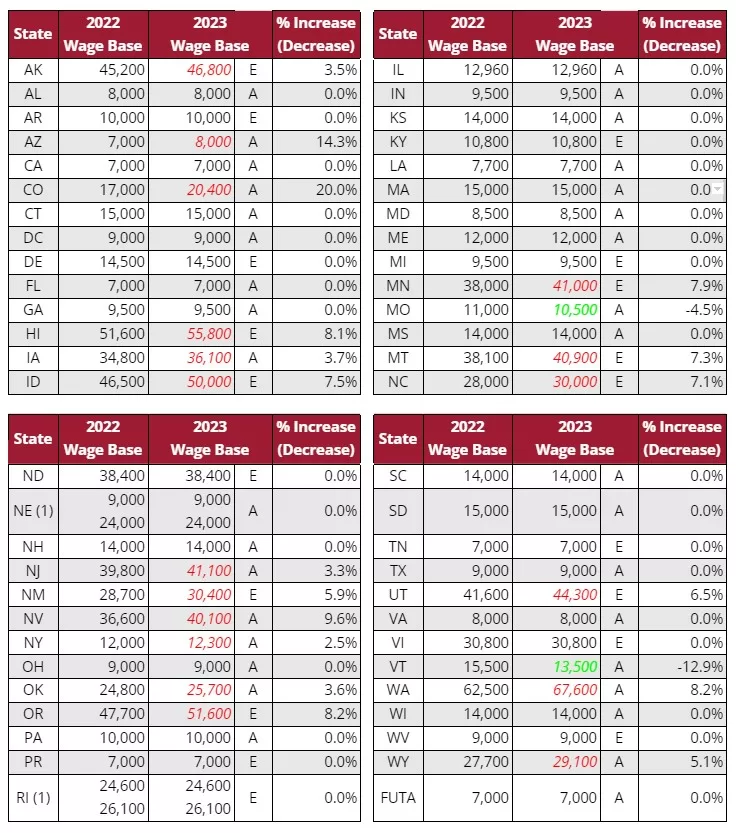

The following table provides 2023 annual taxable wage bases by state, as known as of the date of this article:

Annual Taxable Wage Bases (2022 and 2023)

(1) The higher wage base only applies to employers assigned the maximum rate.

A – Actual wage base, assuming no law change.

E – Our best estimated wage base, assuming no law change.

Courtesy of Equifax