Our Batch eFile option ($99.00/annually) is incredibly helpful if you are responsible for eFiling multiple Federal EINs and especially if those EINs contain small numbers of employees.

Batch eFiling includes the following benefits:

- Reduced minimum eFiling fee! The normal minimum eFiling fee for W-2s, 1099s, and 1095s is $24.95. Once you sign up for batch filing, the minimum fee will drop to $14.95.

- Auto-enrollment. No need to enroll EINs prior to filing.

- Option to have Employee/Recipient copies mailed directly to the company rather than the individuals.

- Multiple filings can be paid at one time.

Call 800-426-0854 to sign up as a Batch Filer or visit https://www.aatrix.com/info/batch-efiling/ for more information.

Batch eFiling Process Is Simple And Easy!

After subscribing as a Batch Filer, your EINs will automatically be enrolled during the eFile process in your payroll software.

To ensure the new taxpayer will be automatically enrolled under your Preparer username:

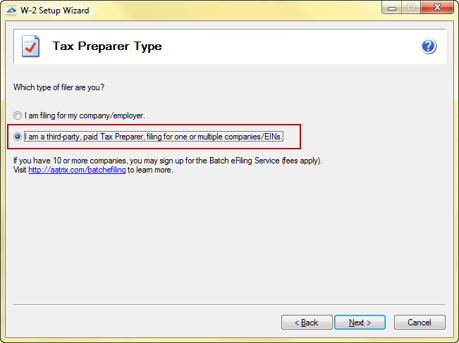

- Be sure to select, I am a third-party, paid Tax Preparer, filing for one or multiple companies/EINs in the Company Setup Wizard during the eFile process.

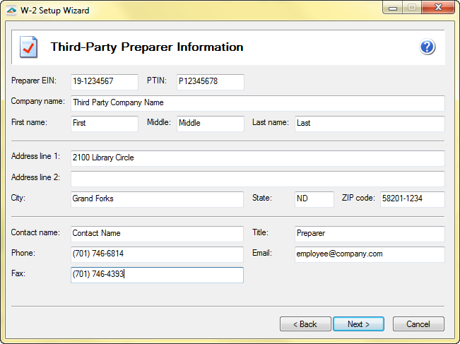

- Then, Enter your Third-Party Preparer Information.

- Once you have completed this information, Aatrix will recognize this EIN as a batch filer.

During the eFile process, you will be able to choose “Pay Now” or “Pay Later” in the eFile Wizard.

If you choose to “Pay Later”, complete the filing by receiving an Aatrix Filing Identifier (AFID). You may then login to https://efile.aatrix.com website to pay for your filings and select mailing options.

If you choose to “Pay Now”, you will be prompted for your mailing options and a credit card number.

Call 800-426-0854 to sign up as a Batch Filer or visit https://www.aatrix.com/info/batch-efiling/ for more information.