Why Verification Is An Important Step For W-2 Filing

Verifying Social Security Numbers (SSNs) greatly reduces SSN Mismatch errors on ACA, W-2, and 1099 filings.

- Correct names and SSNs on W-2 wage reports are the keys to the successful processing of your annual wage report submission.

- It’s faster and easier to use than submitting your requests paper listings or using Social Security’s telephone verification option.

- Results in more accurate wage reports.

- Saves processing costs and reduces the number of W-2c’s.

Verification allows the Social Security Administration (SSA) to give the proper credit to your employees’ earnings record, which will be important information in determining their Social Security benefits in the future.The SSA allows employers to verify the names and Social Security Numbers of employees against SSA records. This should be done prior to W-2 filing for any employees that have not been verified in the past. While the service is available to all employers and third-party submitters, it can only be used to verify current or former employees and only for wage reporting (Form W-2) purposes.

Compliance with W-2 filing is dependent on correct SSNs. It is a common reason for file rejections that can result in fines and penalties, in addition to the cost of refiling and issuing corrected W-2s to employees. Although most services and software verify the SSN is properly formatted, only verifying the Social Security Number with the SSA can ensure the SSN matches the employee’s name.

ACCESSING THE VERIFICATION PROCESS

Although businesses can access the verification process through the Social Security Administration, it is typically complicated and requires separate registration for the Business Services Online tool (BSO) and accessing the Social Security Number Verification Service (SSNVS). A easier, more seamless process is offered free of charge to Aatrix eFile Package subscribers through our secure eFile process. Access the SSN Verification Form in your forms list to try it.

WHAT TO DO IF AN SSN FAILS TO VERIFY

FAILED verification codes.

- 1 = SSN not in file (never issued).

- 3 = Name matches; DOB does not match.

- 5 = Name does not match; DOB not checked.

- 6 = SSN did not verify; other reason.

Follow these steps for each SSN that failed verification:

1. Recheck the employee’s information on file. If the information contained a typo simply resubmit the corrected information. If the name is hyphenated variations can be resubmitted for verification.

2. If the employment records match the submission, contact the employee to verify their information to determine if any name or SSN difference between your records and their card is evident. If the employment records do not match, correct the record and resubmit the corrected data.

3. If the employment record and the employee’s Social Security card match, request the employee check with any local Social Security Administration (SSA) Office to resolve the issue. Once the employee has contacted the SSA Office, you should correct your records accordingly and resubmit the corrected data.

4. If the employee is unable to provide a valid SSN, document efforts to obtain the correct information. (Documentation should be retained with payroll records for a period of three (3) years.)

5. If unable to contact the employee, document the effort made.

6. If a Form W-2 with an incorrect name and/or SSN has been filed, submit a Form W-2c (Corrected Wage and Tax Statement) to correct the mismatch.

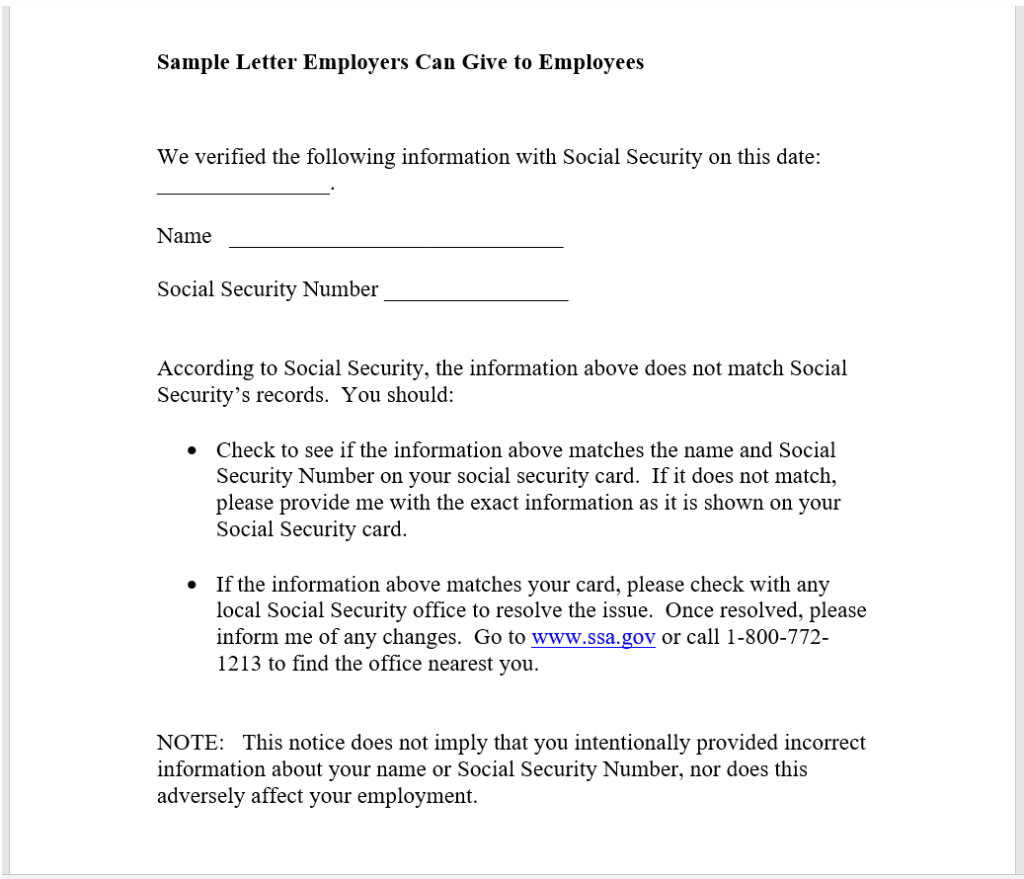

A sample letter the SSA provides for employee contact is shown below:

PROPER USE OF SOCIAL SECURITY NUMBER VERIFICATION

Social Security Number verification can only be used to verify that the SSN the employer has on file matches what the SSA has on file for the employee. It cannot be used for any other reason.

According to the SSA a mismatch is not a basis, in and of itself, for employers to take any adverse action against an employee, such as laying off, suspending, firing or discriminating.

- Company policy should be applied consistently to all workers.

- Any employer that uses the failure of the information to match SSA records to take inappropriate adverse action against a worker may violate State or Federal law.

- The information received from social security number verification does not make any statement regarding a worker’s immigration status.