Federal law requires employers to withhold certain taxes from their employees’ pay—typically income, Medicare, and social security taxes. In addition, employers are responsible for paying an additional “employer share” of social security and Medicare taxes. Collectively, these withholdings are generally referred to as “payroll taxes.”

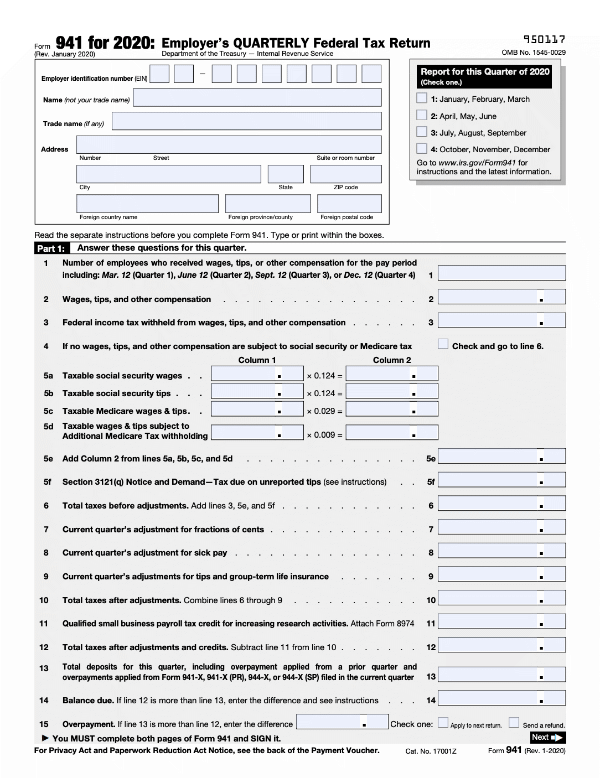

IRS Form 941 is used to report these payroll taxes, as well as wages paid by an employer. The 941 form is also used to pay an employer’s part of Medicare tax or social security, according to the IRS.

What You Need To Know About The New Revised 941 IRS Form

The IRS has now published a revised Form 941 to be used for the rest of 2020. The new 941 form includes the changes made by the Families First Coronavirus Response Act and the Coronavirus Aid, Relief, and Economic Security Act that added various types of payroll tax relief.

Specifically, the new IRS 941 form adds lines to account for:

- Credit for Qualified Sick and Family Leave Wages;

- Employee Retention Credit; and

- Deferred Amount of the Employer Share of Social Security Tax.

The IRS also has published 17 pages of instructions related to the new revised IRS 941 form.

When is the 941 filed?

Tax deposit dates and form filing dates are different.

Form 941 is a summary of what has already paid in payroll taxes and must be submitted quarterly.

Filing dates are:

1. April 30th for Q1

2. July 31 for Q2

3. October 31 for Q3

4. January 31 for Q4 of the previous year.

These Form 941 filing dates may have been changed due to continued legislation related to Covid-19. You can follow Federal employer tax related news at https://www.irs.gov/coronavirus-tax-relief-and-economic-impact-payments.

Payroll Tax Deposit Due Dates

Monthly deposits must be made by the 15th day of the month following the month when you paid employees. For example, if you paid employees in July, you must make a deposit no later than August 15.

Semi-weekly deposits are made on the following schedule:

- Deposit taxes from payrolls paid on Saturday, Sunday, Monday, or Tuesday by the following Friday.

- Deposit taxes from payrolls paid on Wednesday, Thursday, or Friday by the following Wednesday.

Next-day deposits. If your payroll tax obligation is $100,000 or more, you must deposit the next day and you must continue to make next-day deposits for the rest of that year and the following year.

There is no penalty for deposit errors if they don’t exceed $100 or 2% of the amount of employment taxes required to be deposited. You must make up the balance by a predefined make-up day in order to avoid further penalties.

IRS Form 941

The new instructions for the Revised Form 941 are quite extensive and can be downloaded at https://www.irs.gov/pub/irs-pdf/i941.pdf

Aatrix Software provides automated Form 941 as part of their Fed and State Payroll Reports solution integrated into over 60 popular payroll products. Developers can add this powerful feature to their desktop or online payroll solution with minimal development costs and create improved customer loyalty and a new revenue stream in less than 90 days. For more information go to aatrix.com/partners.

Aatrix Payroll Reporting Software Testimonial

‘We built Aatrix directly into our existing Tax menus and replaced our old process entirely. We did this for several reasons, 1) to lower our R&D costs on maintaining compliance within payroll 2) to lower our support costs because one process is easier to support than two or three processes and 3) to drive all users through Aatrix which will build trust and help to deepen the revenue pool. The other thing that we did was drive Sage Checks and Forms in conjunction with our Aatrix offering. Sage C&F’s offers the four part perforated paper recommended within Aatrix; so for all of the customers printing we drive forms revenue, and for all of the customers eFiling we get filing revenue – it’s a win/win. We have driven awareness by putting Aatrix and the Forms vendor together, building a mini-website, launching free webcasts, building links into MIP, and several other initiatives. The revenue for Aatrix and Sage C&F’s has gone up about 200% in the past 24 months.’

Brooke Huling, Sage MIP Fund Accounting