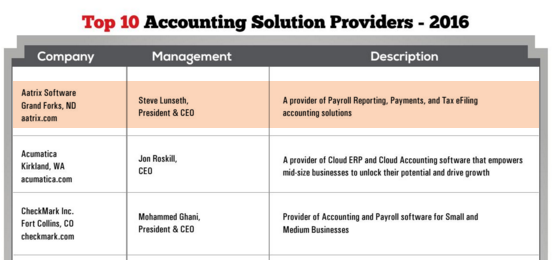

FREMONT, CA—January 20, 2016— Aatrix Software makes it to CFO Tech Outlook’s Top 10 Accounting Solution Providers list for its expertise in its Aatrix State Payroll Reports™ module for Windows. Annual list showcases the Top 10 Accounting Solution Providers 2016. The positioning is based on evaluation of Aatrix Software’s specialties in creating a comprehensive state and federal payroll reporting solution module that could be integrated with any accounting software. The annual list of companies is selected by a panel of experts and members of CFO Tech Outlook’s editorial board to recognize and promote Technology entrepreneurship.

Aatrix Software has been selected after being evaluated across more a dozen quantitative and qualitative elements. Experts have made the decision by taking to consideration, company’s experience, industry recognition, technical certifications, market presence and positive client reviews. “Aatrix Software has been on our radar for some time now for stirring a revolution in the Accounting Technologies, and we are happy to showcase them this year due to their continuing excellence in delivering top-notch technology-driven solutions,” said Jeevan George, Managing Editor, CIOReview. “Aatrix Software continued to break new ground within the past year benefiting its customers around the globe, and we’re excited to have them featured on our top companies list.”

Article Link: http://www.cfotechoutlook.com/vendor/article9/aatrix_software

Magazine Link: http://cfotechoutlook.com/magazines/January/2016/

About CFO Tech Outlook

CFO Tech Outlook is a magazine based in Fremont, California that deals with how current technological developments are influencing the business prospects of the corporate houses and how they are responding to these innovations. Through nominations and consultations with industry leaders, its editors choose the best in CFO domain. CFO Tech Outlook’s January Edition is an annual listing of Top 10

Accounting Solution Providers. For more information, visit the website at: http://cfotechoutlook.com/