Myth: All Tax-Free Benefits Are Exempt From Payroll Taxes

Reality: Receiving tax-free fringe benefits means that employees do not have to pay income tax on what they receive. However, it does not mean that employers are off the hook for payroll taxes. For example, 401(k) contributions made by employees through salary reductions are still subject to FICA. Adoption assistance is exempt from income tax withholding because the benefit is tax free to employees but is still subject to FICA and FUTA taxes.

In most cases, the excluded benefits aren’t subject to federal income tax withholding, social security, Medicare, federal unemployment (FUTA) tax, or Railroad Retirement Tax Act (RRTA) taxes and aren’t reported on Form W-2.

This section discusses the exclusion rules for the following fringe benefits.

- Accident and health benefits.

- Achievement awards.

- Adoption assistance.

- Athletic facilities.

- De minimis (minimal) benefits.

- Dependent care assistance.

- Educational assistance.

- Employee discounts.

- Employee stock options.

- Employer-provided cell phones.

- Group-term life insurance coverage.

- HSAs.

- Lodging on your business premises.

- Meals.

- No-additional-cost services.

- Retirement planning services.

- Transportation (commuting) benefits.

- Tuition reduction.

- Working condition benefits.

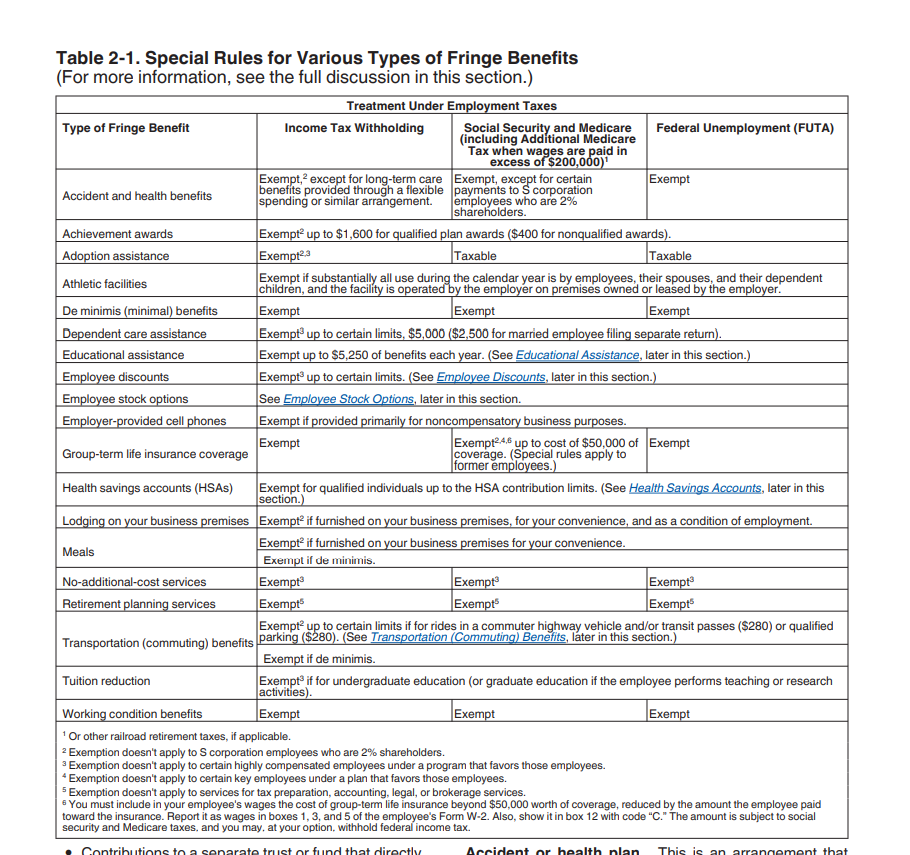

Although these benefits are exempt from employee income tax, some are not exempt from Medicare, Social Security, and FUTA taxes. The table provided by the IRS used to determine which items are exempt is shown below:

Story sourced from the SBA and IRS.