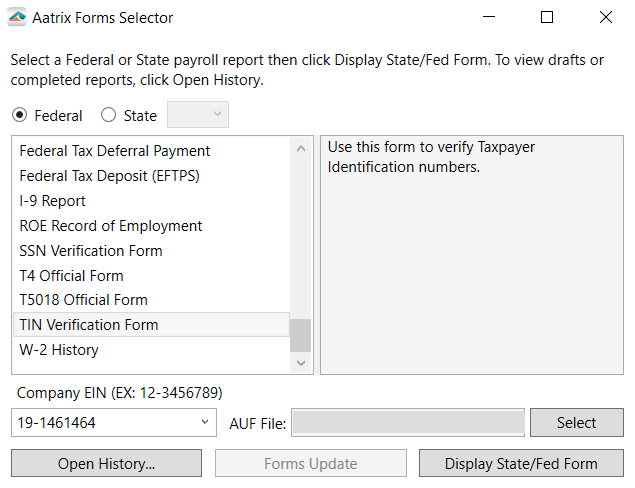

The TIN Matching Service using Aatrix, works seamlessly with your payroll and accounting software. Choose the TIN Matching Report from your Federal Reports list, enter the date range for your request date range.

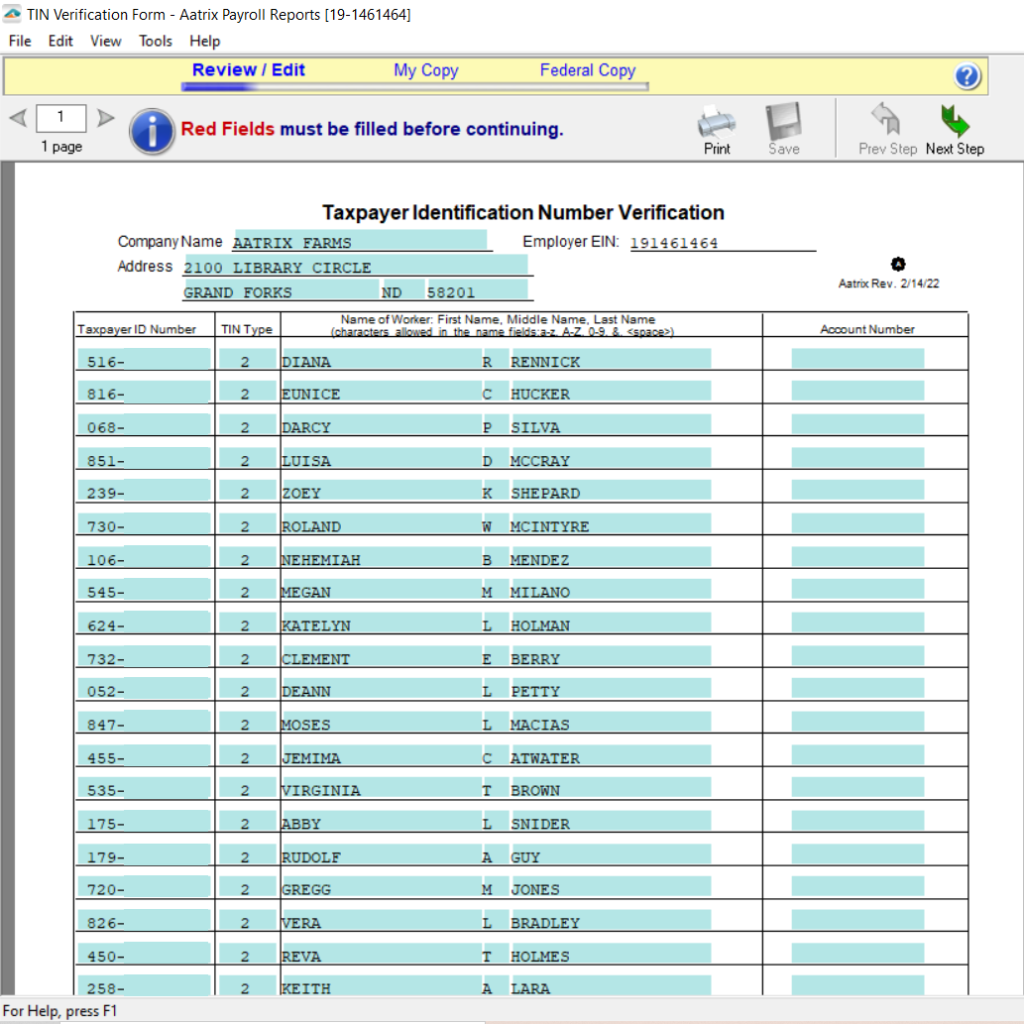

Click “display” and the form will be filled in automatically.

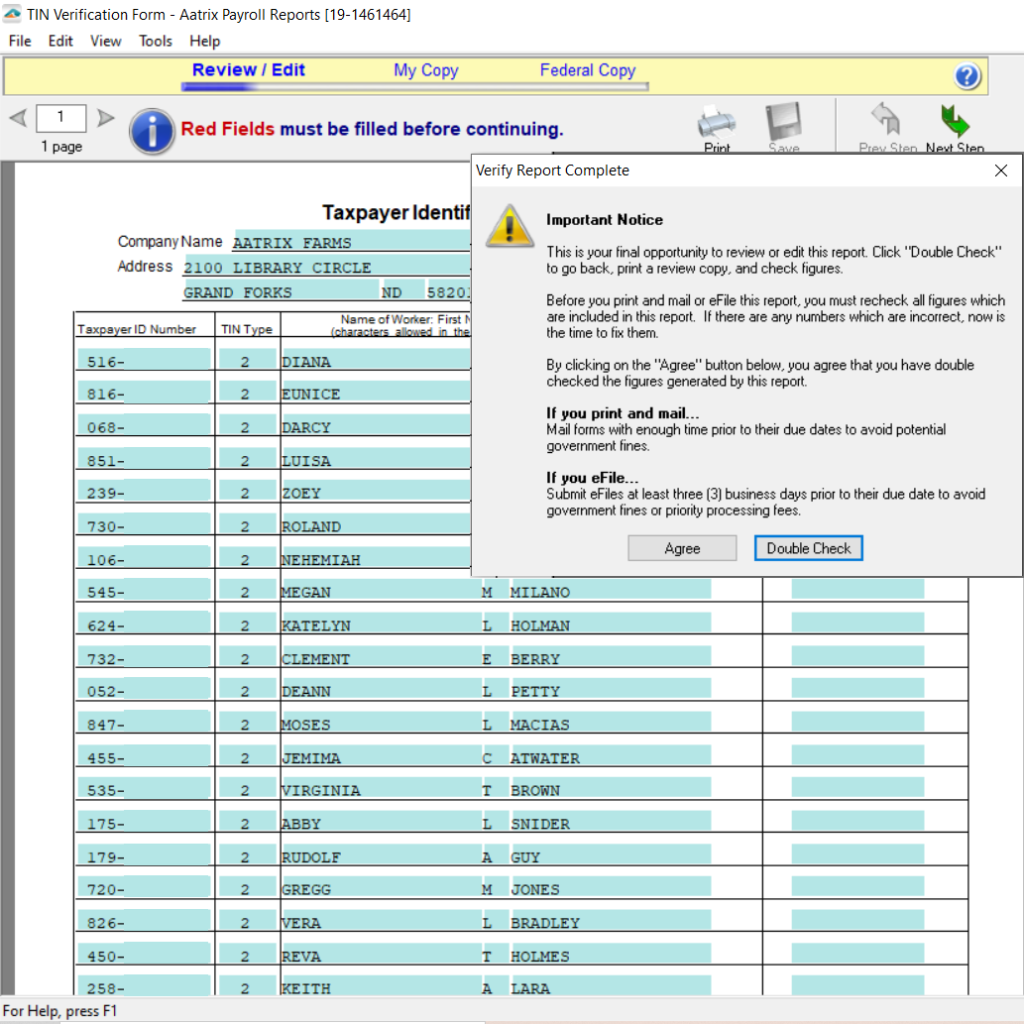

You will review and edit this information onscreen. Once you click “Next” you will be given one last chance to confirm you are ready to continue or go back and review again.

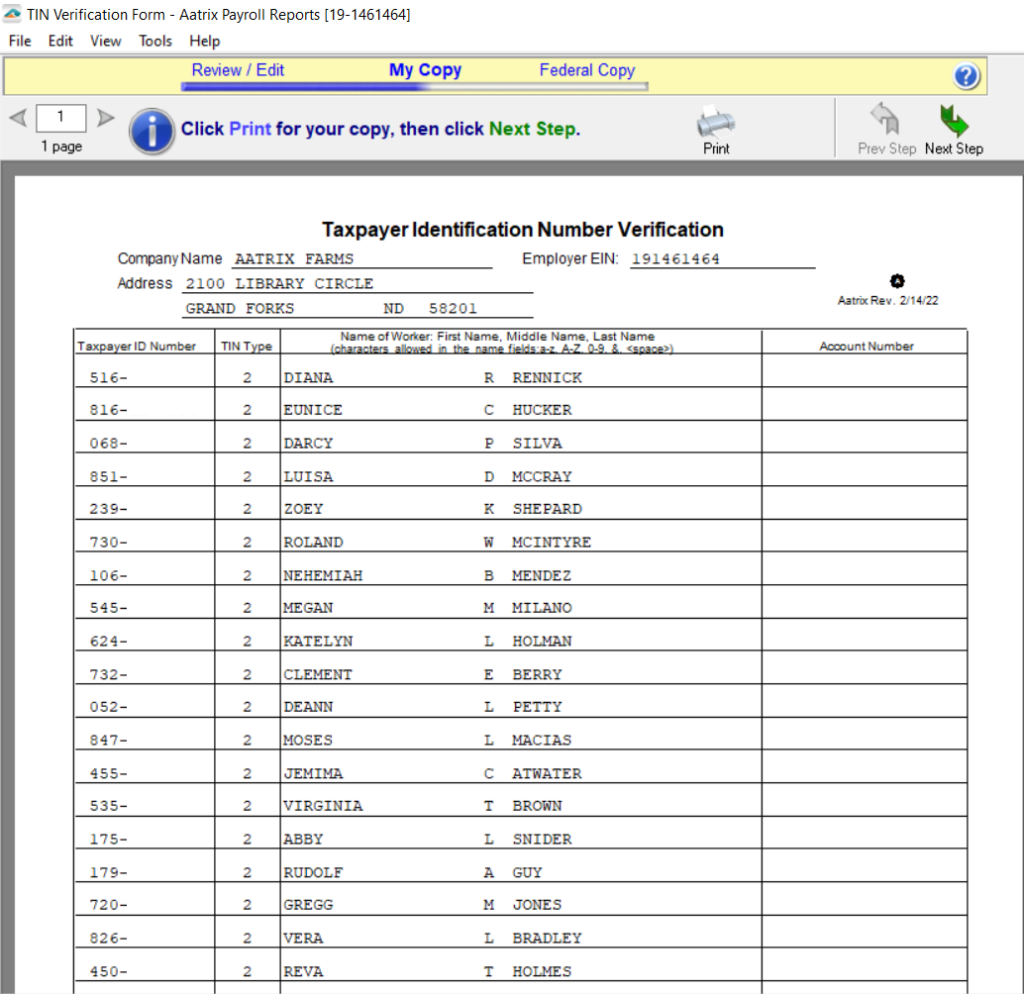

If you agree that the information is correct the form will then be saved and date stamped, ready to be eFiled.

Simply click “eFile” and the report will be sent to the IRS for verification. You will receive an email from Aatrix if there are any issues with the TINs you have submitted.

TIN verification is included with the Aatrix Unlimited eFile Package which also supports Federal and State Unemployment, Wage Withholding, New Hire Report and Payments.