A Safe & Secure Payroll Reporting Solution

With over 200 State and Federal taxing authorities in the US, businesses are faced with different forms, reporting methods, and other unique requirements for each agency to stay compliant. A business required to file in as few as three states is confronted with more than a dozen processes for logging in, filing, and confirmations.

A recent survey found that 63% of employers never realized how much time they spent on payroll. 70% said diverse labor laws across states complicated the process. Small business owners said they spend about 111 minutes to calculate paychecks, 96 minutes to file taxes, and 95 minutes to complete payments. It’s important to note employers spend almost twice as much time processing tax reports and payments as they do actually processing payroll checks. Aatrix provides your customers a single secure solution for Unemployment, Wage Withholding, New Hire reports, and payments. Aatrix supports all year-end reports, including W-2s, 1099s, and 1095s. Additional forms include certified payroll reports, HR forms, FMLA, EE01, Form 7200, and more. Formslist

The Aatrix Single-point eFile Center allows your customers to eFile any of these reports and associated payments.

One Process

One Website

One Support Group

One Comprehensive Process

The Aatrix solution is a secure in-house solution that meets the needs of your customer’s desire for a simple and efficient payroll reports and payments process.

This allows employers to minimize costs, maintain control, and dramatically reduce the time spent completing State and Federal reports and making payments/deposits.

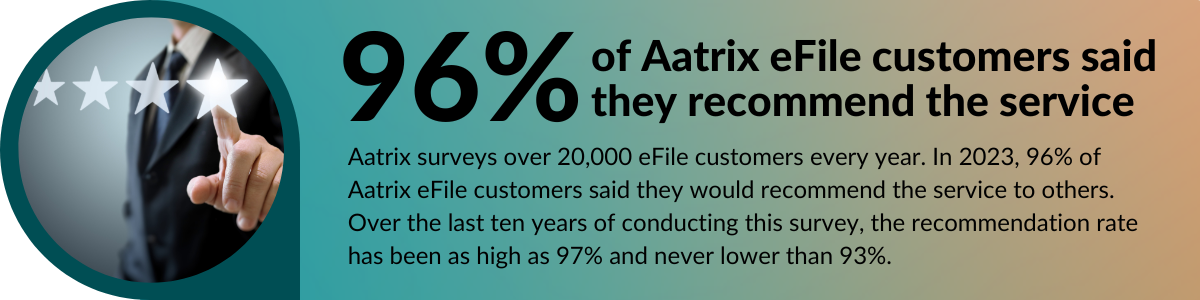

Customer satisfaction directly affects attrition, the ability to attract new customers, and virtually every opportunity to promote your solution through social media.

Get Started Today!

(Please check your Junk / Spam mail folder after form submission.)