The Aatrix 1095 (ACA) eFiling Service* works with virtually any Payroll Software. Download the Aatrix ACA WeFile Preparer for Desktop or use the Aatrix ACA WeFile Web Preparer.

Simply download and complete the ACA Spreadsheet template below using information exported from your Payroll Software to load your Employee Data, eFile your Federal and State copies. Your employee copies will be mailed directly to them as well as have them posted to a secure website.

ACA (1095) eFiling Service

Free Software

Setup your efile account

Deadlines

*The Software is FREE and available for Windows users. There is no obligation to eFile.

You don't pay to download the software, only to eFile. Enroll for eFiling while downloading the software or enroll after you have tried the software to obtain a username and password.

ACA (1095) eFiling Service

| ACA eFile Pricing | |

COMPLETE ACA eFile Service

|

$2.79per employee |

**1095-C Filed with W-2 COMPLETE eFile Service**Save 50% if you file the W-2 COMPLETE Service first, and then file the ACA COMPLETE Service in time to be combined before mailing. Click here for instructions. |

$1.40per employee |

Online ACA eFile Service

|

$1.29per employee |

Federal ACA eFile Service

|

$0.55per employee |

|

$27.99 minimum applies to all ACA filings. $16.99 minimum applies to all correction filings submitted after the Federal 1095s have been processed. |

|

Sign up to download our FREE Windows Software:

(Please check your Junk / Spam mail folder after form submission.)

There's no need to complete this registration form if you are using one of our Partner’s Payroll or Accounting Solutions. The AATRIX eFile Solution is integrated with your software. Visit https://partner.aatrix.com/ and select your solution to get started or contact your software provider for more information.

Product Demos

Product Help

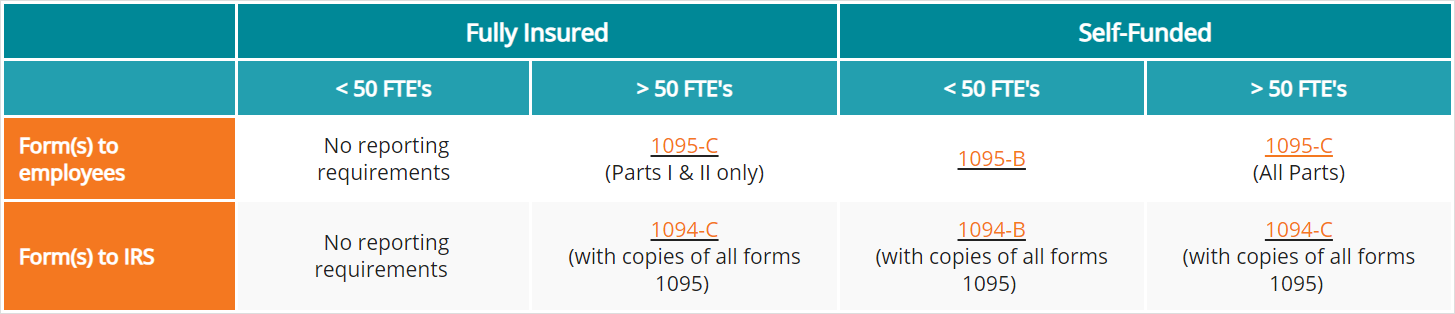

How Do I Know If I Need To Report

Below you will find some tools to help you discern if your company needs to comply with ACA reporting.

Full-Time Equivalent (FTE) Chart

For Specific IRS Instructions for Forms 1095-B/C and 1094-B/C, click on the buttons below.

What information is reported?

Employers (your customers) need to be tracking all of the data they will need to report in January on a monthly basis, at an employee level. This includes:

- Total employee count & Full time employee count

- Employee ID, name, and address

- Health coverage offered

- Employee share of the monthly premium (for lowest-cost self-only minimum coverage)

- Months the employee was enrolled in employer coverage

- Affordability safe harbor information

- If self-insured, information about covered individuals in plan

Deadlines

Affordable Care Act (ACA) Full-Time Employee Calculator

We have provided a monthly calculator for you.

To aid in determining if your company is required to report under the

Affordable Care Act (ACA), the following information is required.

***This is not intended as tax advice and you should consult your accountant or HR Specialist to confirm these results.***

What type of health coverage is sponsored by your company?

Are you part of an Aggregated Group?