1099 Initial Filings (Windows OS)

A guide for new users of AATRIX 1099 eFiling Services

Jump to section

Filing Instructions

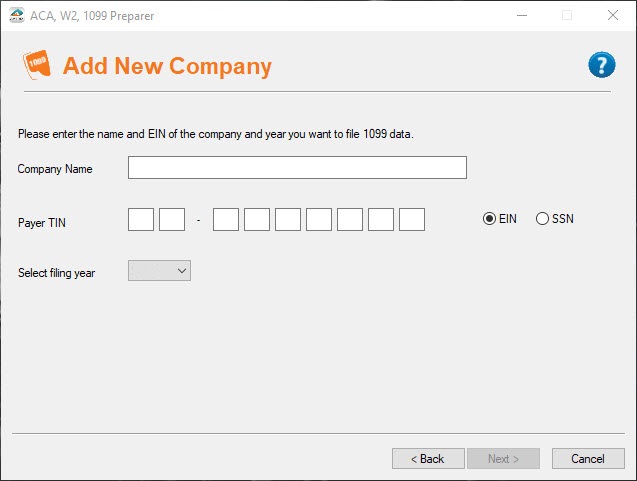

Initial Company Information

The Aatrix 1099 eFiling Service allows you to file 1099s for multiple companies. When you enter the program for the first time, the first screen will allow you to add the company information.

The next time you enter the software, it will display a dialog asking if you want to file for an existing company or start a new one. All companies are stored separately, so you can file for as many companies as needed without confusion.

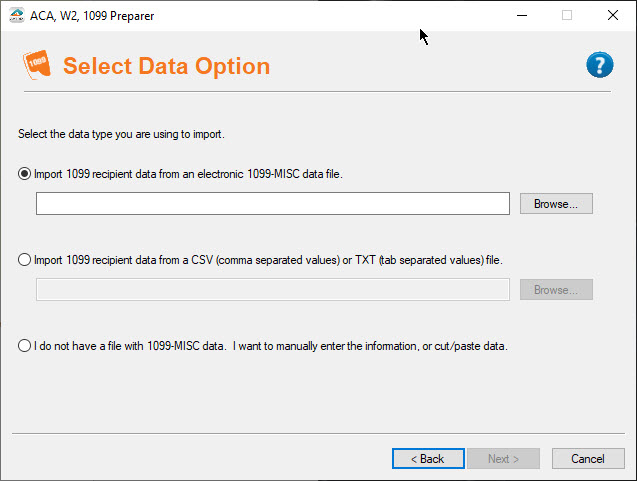

Data Options

There are three options for entering data into the 1099 eFiling Service:

- Use an EFW2(MMREF) or EF1099(Pub 1220) data file exported from the payroll or accounting software. Save it as a .TXT file or remove the file extension completely.

- Use an existing spreadsheet or data file exported from the payroll software and save it as a .CSV or .TXT file.

- Manually enter employee data into the employee grid.

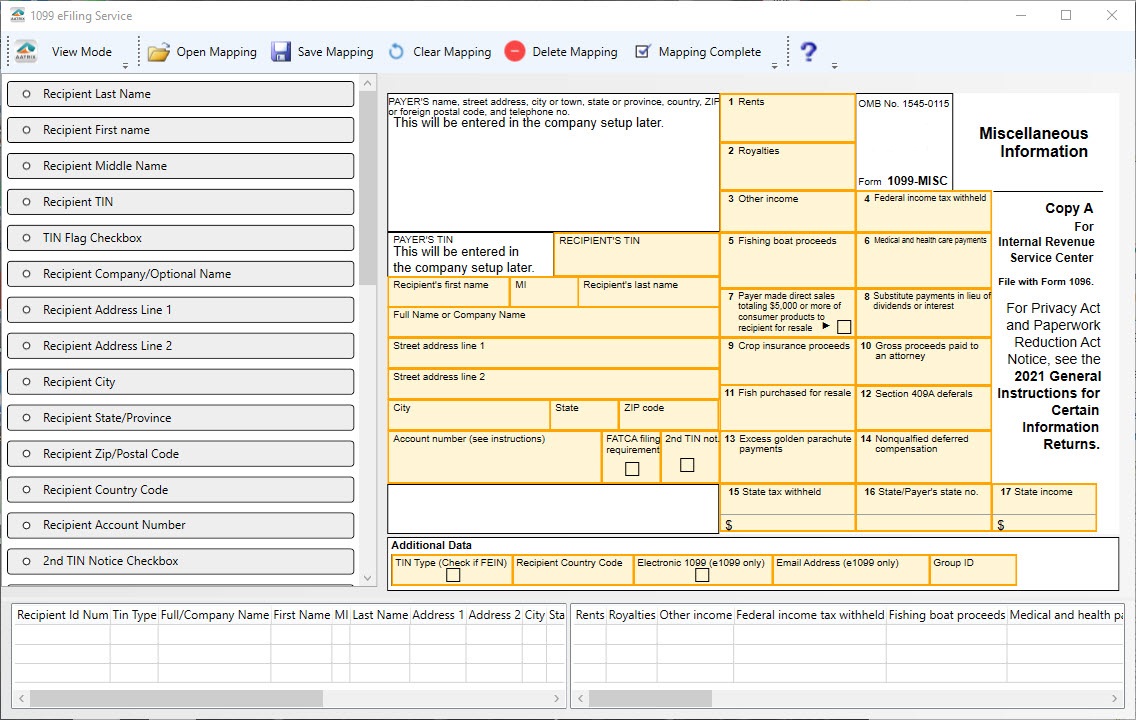

Mapping Your Data

If you select to import a CSV or TXT file, the 1099 eFiling Service will identify all the columns in your file and take you into a mapping tool where you can link each of your column headers to the appropriate boxes on the 1099 form.

The mapping tool is a simple drag and drop tool that makes mapping data to the 1099 simple. There is also a grid view at the bottom of the screen to preview your data to make sure you are mapping the correct data to the form and also a preview mode to view what the actual 1099s look like.

If the data is not accurate when mapping; you will have a chance to edit the data in the 1099 employee grid in a future step.

Saving your Mappings

If you are filing for multiple companies, or cannot finishing your mapping in one pass, there is an option to saving the mapping in a .TDX file format to use in the mapping tool for importing files in the future. This is a great feature that will save time when mapping multiple employee files.

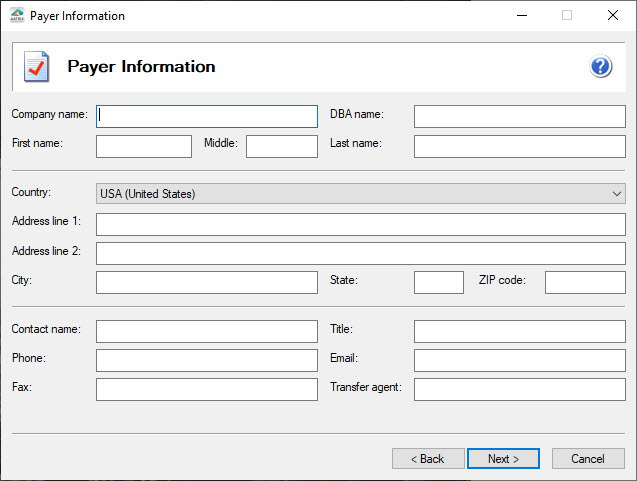

Company Setup Wizard

Once all your data is imported and mapped, a company setup wizard will appear for you to enter all your company information. This is the information that will display on the 1099 and 1096 forms.

There is also a special 1099 data validation dialog to help you determine what kind of error checking will be needed in the 1099 recipient grid. All the information is stored in the company setup wizard so you only have to enter the information once, unless you need to change it.

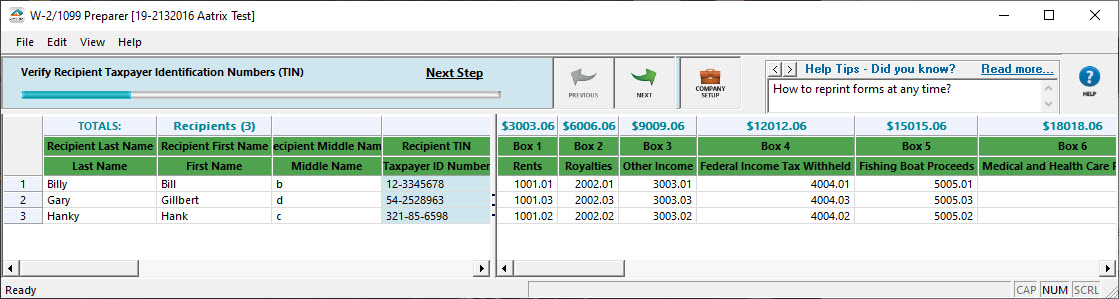

Reviewing your 1099 Employee Data

After the company setup wizard, the employee data preparer displays. This preparer functions like a Microsoft Excel spreadsheet with features like sorting, copy, paste, etc. This is where you will be able to review all your employee data and add, remove, or adjust data as needed.

Over 80 error checks are performed during this process to reduce the chance of your 1099 filing getting rejected by the SSA or State agency.

1099 Processing Wizard

After you have reviewed all of your data in the recipient grid, a 1099 processing wizard will appear for you to select how you want to eFile your 1099s.

The Complete eFile Service allows you to eFile all of your 1099s in one shot including:

- Recipient 1099s printed, and mailed by the eFile Center. *This includes electronic 1099s for recipients.

- eFile Federal 1099s and 1096

- eFile State 1099s and required reconciliation forms

- Print Payer copies

This option gives you the best value and allows you to submit a free replacement filing until your filings is submitted by the eFile center.

If you don't want to go with the Complete 1099 eFile Service you have other options available to you, please check this 1099 Pricing Table »

Remember: You always have the option of returning back to the 1099/1096 wizard and processing additional 1099s. So you might want to do only Federal 1099s today and come back next week and eFile your State 1099s.

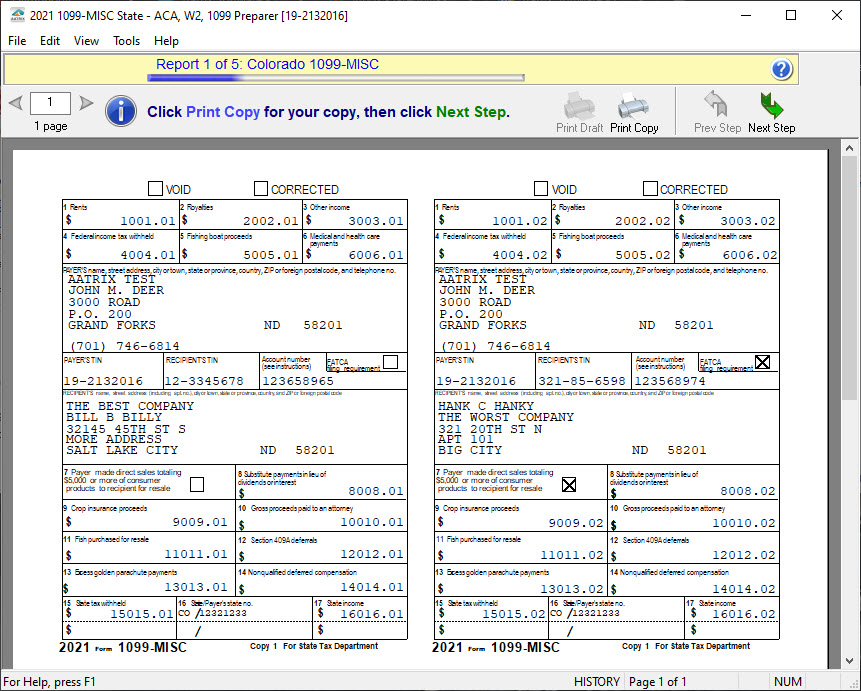

Review The Forms

A FormsViewer will display the actual forms that will be eFiled along with the state reconciliation forms where you will be able to edit the state reconciliation forms if needed and supported locality form.

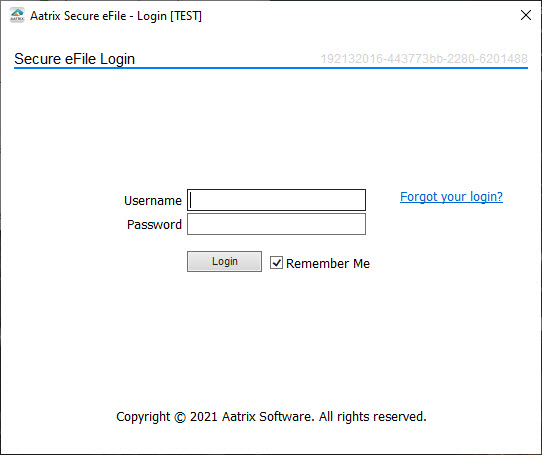

Submit Your eFiling

An eFile wizard will take you through uploading your files to the eFile Center.

A username and password is required. If you have not already enrolled for eFiling you will see a message to enroll or you can go to the Aatrix eFile Center to enroll at any time.

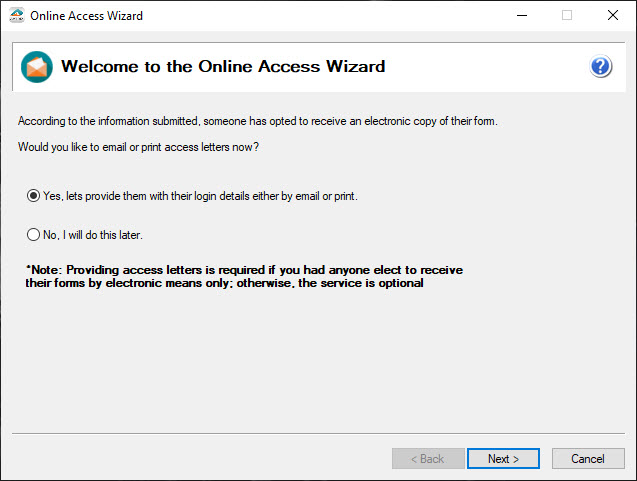

Online 1099 Wizard

If the Complete 1099 eFile Service was selected, you will see an online 1099 wizard after the forms have been submitted. This wizard allows you to print or email access letters to employees for their electronic 1099s that are accessible through secure website.

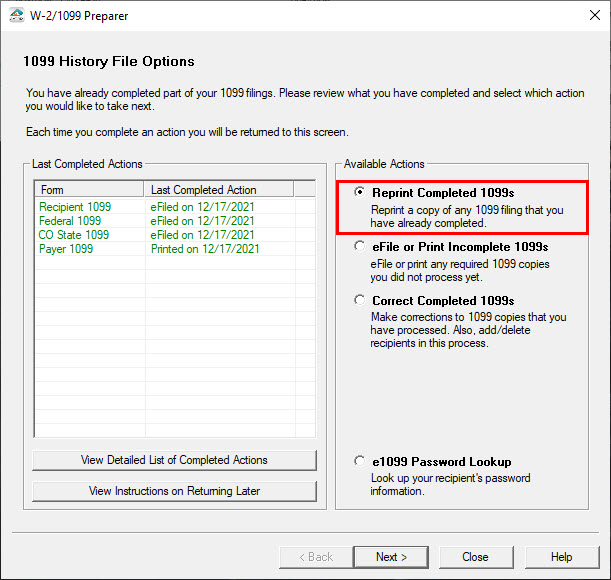

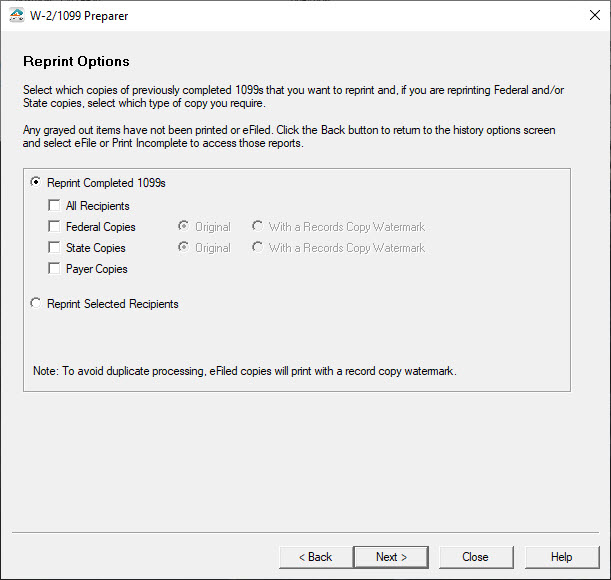

Reprinting

If you have already submitted filings for a company, all the history files are saved and you are able to reprint copies of everything that was submitted at any time by opening that company and selecting reprint from the 1099 History File Options screen.

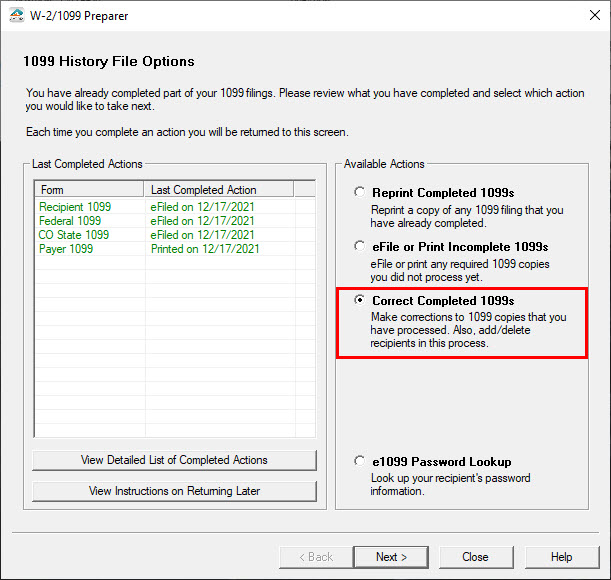

Corrections

The eFile Center offers free replacement filings until your filings are submitted to the SSA or State.

If you need to make corrections to your employee or company data, simply open the preparer, and select to open the company and select to Correct Complete on the 1099 History File Options screen.

The 1099 recipient preparer will appear and you can update the needed information. Any data that you change in the grid will change the text to blue.

If you need to update the company information, select "Update Company Information" from the "Edit" menu in the employee grid and go through the company setup wizard again and make any changes.

A web service with the eFile Center automatically determines the status of your filings and if they have not been submitted the FormsViewer will simply display new forms with the updated information. Submit your filing to the eFile Center and they will replace your previously submitted filing free of charge.

If the web service determines that your filings have been submitted by the eFile Center, you will be displayed Correct 1099s for the Federal copies and Recipient copies. The state Correct 1099s will display for you to print as they are not supported by the eFile center. You will then submit the Correct 1099s to the eFile Center and you will be charged the per employee cost for each corrected employee with a minimum of $9.95.

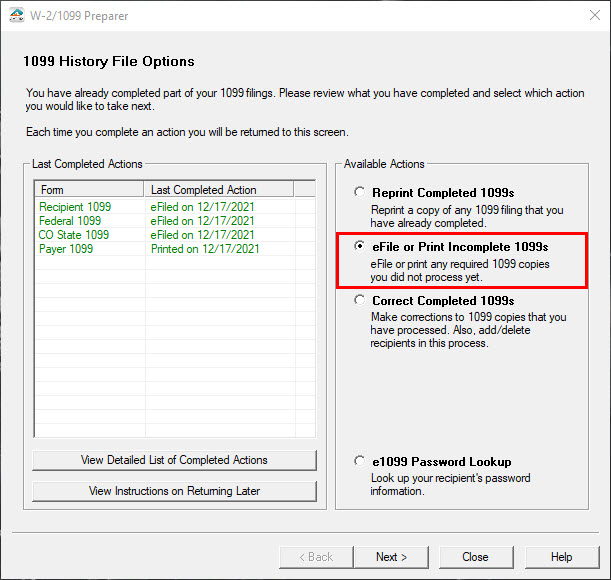

Additional Filings

You don't have to submit all your 1099s types at the same time in the Aatrix 1099 eFiling Service.

If you select to only file your Federal 1099s the first time but then decide that you want to now file the Complete 1099 eFile Service, simply open the company again and select "eFile" or "Print Incomplete 1099s" from the 1099 History File Options screen.

The eFile Options screen will then display for you to select your options and you will be displayed the forms in the FormsViewer and will be able to submit your forms to the eFile Center through the eFile Wizard.

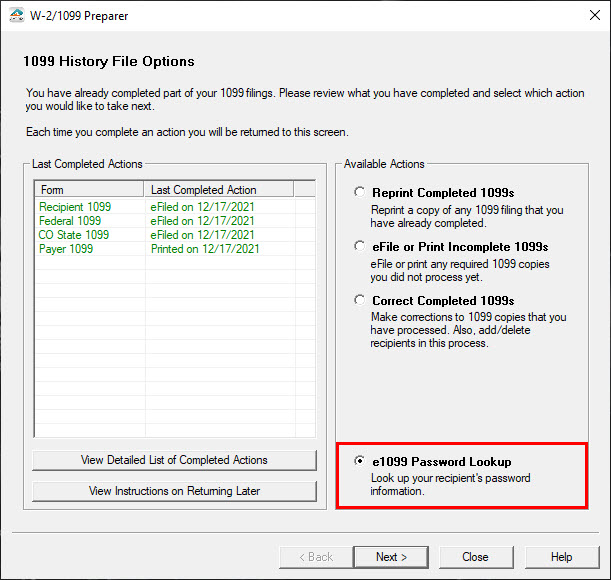

Online 1099 Password Look

If you eFiled using the Complete 1099 eFile Service you have the option of looking up, printing or emailing an existing online 1099 password for the recipient hosted electronic 1099s.

Simply open up the company and select the e1099 Password Lookup option on the 1099 History File Options screen and you will be displayed the Online 1099 Wizard.

W2 eFiling Service

Complete W2 eFile Service

- Employee W2s Mailed

- Employee W2s Hosted Online

- Federal W2s & W3 Filed to SSA

- State W2s Filed

- State Reconciliation(s) filed

Online W2 eFile Service

- Employee W2s Hosted Online

- Federal W2s & W3 Filed to SSA

- State W2s Filed

- State Reconciliation(s) filed

Fed & State W2 eFile Service

- Federal W2s & W3 Filed to SSA

- State W2s Filed

- State Reconciliation(s) filed

Fed Only W2 eFile Service

- Federal W2s & W3 Filed to SSA

State Only W2 eFile Service

- State W2s Filed

- State Reconciliation(s) filed

Local W2 eFile Service

- eFile in combination with any eFile

- Select Local W2s Filed

- Local Reconciliation(s) filed