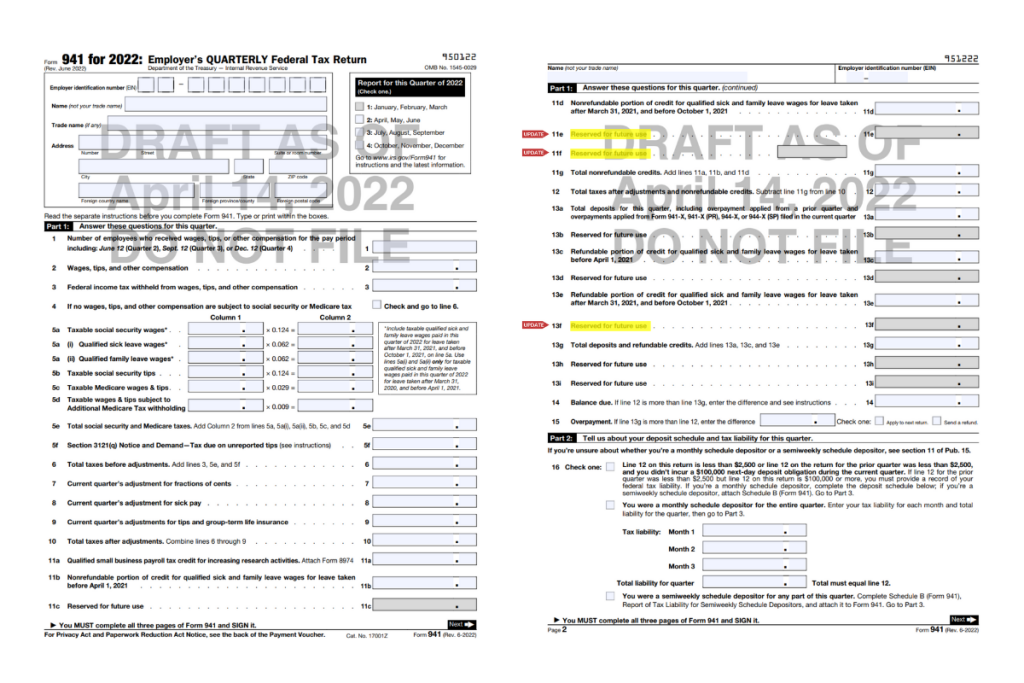

Proposed 941 Q2 Changes

The IRS has released a draft of the Q2 941 for 2022

The only apparent change is the removal of lines 11(e) and (f) and 13 (f). These lines were used to report COBRA premium assistance credit.

Forms and instructions generally are subject to Office Of Management and Budget approval before they can be officially released. Drafts of instructions and publications usually have some changes before their final release.

Notice To Filers Who Have Not Submitted and Certified Their 2021 EEO-1 Component 1 Report(s):

The published deadline to submit and certify the 2021 EEO-1 Component 1 Report(s) was Tuesday, May 17, 2022. All filers who have not submitted and certified their mandatory 2021 EEO-1 Component 1 Report(s) by the above May 17, 2022 deadline will have through Tuesday, June 21, 2022, to submit and certify their 2021 EEO-1 Component 1 Report(s).

Please submit and certify your company’s 2021 EEO-1 Component 1 Report(s) as soon as possible and no later than Tuesday, June 21, 2022, to comply with the EEOC’s mandatory filing requirements. Once the June 21, 2022 deadline passes, no additional 2021 EEO-1 Component 1 Reports will be accepted, and eligible filers will be out of compliance with their mandatory 2021 EEO-1 Component 1 filing obligation.

Utah Tax Bulletin 07-22 tax.utah.gov Effective: May 1, 2022

Re: New Withholding Tables (Publication 14)

The 2022 Utah Legislature passed SB 59, which lowered the state individual income tax rate from 4.95 percent to 4.85 percent. This change is effective for tax years beginning January 1, 2022, affecting employer withholding. Utah has revised the tables in Publication 14, Withholding Tax Guide, to reflect these changes. The updated withholding tables are effective for pay periods beginning May 1, 2022. See tax.utah.gov/withholding for details.

Maine Requires Employers to Pay Employees or Accrued Vacation Upon Termination

All unused vacation time accrued according to an employer’s vacation policy in Maine after January 1, 2023, must be paid to the employee on termination.

An employee leaving employment must be paid in full no later than the employee’s next established payday. Any overcompensation may be withheld if authorized under section 635, and any loan or advance against future earnings or wages may be deducted if evidenced by a statement in writing signed by the employee. The terms of employment or the employer’s established practice include provisions for paid vacations, and vacation pay, upon the termination of employment, has the same status as wages earned.

Effective January 1, 2023, private employers with 11 employees or more will be required to pay out all accrued unused vacation on termination of employment. This covers situations where an employee leaves the job, as well as when a business shuts down.

When employees are covered by a collective bargaining agreement (CBA) that includes provisions addressing payment of vacation pay on termination, the CBA will govern the payment.

Aatrix continuously monitors any changes to payroll reports and filing to ensure your filings are always accurate and meet the most current compliance requirements.